Debt

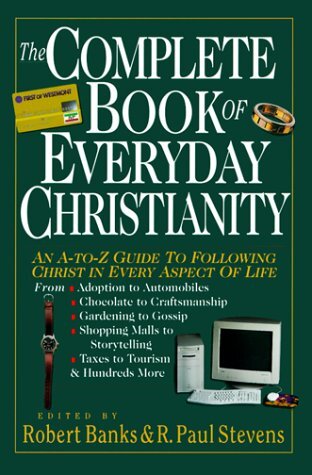

Book / Produced by partner of TOW

Ben Franklin once said that it was better to “go to bed supperless than run in debt for breakfast.” In more recent times North Americans have failed to heed his advice. The result has been an explosion in personal debt—and bankruptcies! Though I will focus on the subject of debt, one cannot really talk about this without also considering the related topic of credit.

While debt has been a subject of considerable discussion in Christian circles for a long time, it was probably the explosion of business and personal bankruptcies in the 1980s that brought unusual attention to the topic and even caused some Christians to doubt their standing before God. Over five million Americans filed for bankruptcy in the decade of the 1980s. Canada realized proportionately similar numbers. In fact, it was only in 1993 that bankruptcy statistics actually began to decline from the record total realized the previous year.

Many Christian commentators were quick to condemn Christians who took this avenue of escape from their debts. American businessperson and author Albert J. Johnson suggested that those considering voluntary bankruptcy to resolve debt problems should read Psalm 37:21, “The wicked borrow and do not repay.” He argued that a person considering bankruptcy was in financial trouble because of past violations of scriptural principles (Johnson, pp. 82, 85). Widely published financial and business adviser Larry Burkett is similarly outspoken, as is evident in one of his taped addresses:

Now isn’t that amazing to you, that somebody would actually default on a debt that they created legally, morally, ethically, and then they would default on it? See, it ought to never happen with Christianity, or it should happen so rarely that we would take that person, and we would admonish them according to Matthew 18, and bring them before the church to restore them back to the faith.

This hard-nosed attitude toward bankruptcy is sometimes held toward taking on debt generally. Some commentators have argued that debt is a substitute for trust in God and that to be truly effective a Christian must be financially free. Furthermore, debts are viewed as lifelong obligations, ruling out any possibility of their being forgiven via the bankruptcy process. Taken to its extreme, financial success is, in some circles, linked with divine favor and right standing before God, while debt problems are seen as an indication of a Satan-defeated life.

Given the fact that North Americans have taken so readily to consumer and business credit and that indebtedness has become a normal aspect of life for many Christians, it is crucial to know just what the Bible says, and does not say, about the topic of debt. This will enable us to come to sound conclusions about the use of credit.

Is Debt Evil?

If one were to adopt a proof-texting approach to this topic, confusion would assuredly be the result, for the biblical message concerning debt appears at quick glance to be a mixed one. On the one hand, many times God’s people are urged to lend to the needy. Deut. 15:7-10 is particularly forceful:

If there is a poor man among your brothers . . . do not be hardhearted or tightfisted toward your poor brother. Rather be openhanded and freely lend him whatever he needs. Be careful not to harbor this wicked thought: “The seventh year, the year for canceling debts, is near,” so that you do not show ill will toward your needy brother and give him nothing. He may then appeal to the Lord against you, and you will be found guilty of sin. Give generously to him and do so without a grudging heart; then because of this the Lord your God will bless you in all your work and in everything you put your hand to.

Our Lord takes a similar view, not only with respect to one’s brothers and sisters, but even with one’s enemies: “Love your enemies, do good to them, and lend to them without expecting to get anything back. Then your reward will be great, and you will be sons of the Most High, because he is kind to the ungrateful and wicked” (Luke 6:35) and “Give to the one who asks you, and do not turn away from the one who wants to borrow from you” (Matthew 5:42).

On the other hand, in the Bible we see borrowers, desperate to avoid the exactions of hardhearted creditors, attempting to persuade a third party to act as a guarantor for their debts. The Old Testament frequently warns against this practice (Proverbs 6:1-5; Proverbs 11:15; Proverbs 17:18; Proverbs 22:26-27). In fact, being in debt is sometimes linked with being in a hopelessly vulnerable situation, as Proverbs 22:7 suggests: “The rich rule over the poor, and the borrower is servant to the lender” (see further Deut. 15:6; Deut. 28:12, 44). We also have the Pauline injunction “Avoid getting into debt, except the debt of mutual love” (Romans 13:8 JB).

Given the many times that God’s people are urged to lend, compassionately and generously, to the needy, it would be ridiculous to assert that borrowing, and therefore debt, is evil. However, it is realistic to conclude that incurring debt can be dangerous. This two-edged characteristic is typical of most aspects of material life from the biblical point of view. For example, wealth and property can be seen as gifts from God and even as a reward for obedient living (Deut. 28:1-14). Their value is in the opportunities that they provide for increased service to humanity (2 Cor. 9:11), rather than for self-indulgent use (Luke 8:14). But material wealth at the same time is one of the chief obstacles to salvation (Luke 12:13-21; Luke 16:19-31; Luke 18:24-25).

One cannot arbitrarily conclude, then, that debt is inherently evil. God would not command his people to proffer help that was wrong to receive. But debt, like so many other aspects of economic life, can be abused by the lender and borrower alike. Thus, care must be taken to use debt wisely.

What Was the Purpose of Debt?

Virtually all of the ethical teaching about debt is found in the Old Testament. In the economy of Pentateuchal times, Israelites were involved almost exclusively in agriculture. The most common commercial participant in those days was the traveling merchant or trader, called simply a “foreigner” (Deut. 23:20) or sometimes a “Canaanite” (Zech. 14:21). While Israelites were to lend to their fellow Israelite farmers interest free, making loans with interest to foreigners (or traders) was permissible.

It was with respect to the interest-free loans to covenant brothers and sisters that the lender was urged to be compassionate, taking minimal collateral and forgiving unpaid debts by the sabbatical year (more on this below). Loans would have typically been solicited not for commercial investment purposes but as a result of economic hardship, for example, crop failure or the devastation that resulted from enemy raids (Judges 6:1-4). Borrowing was an indication of serious financial trouble, imperiling the well-being of the family unit, which was the fundamental building block of society. Thus, while the debtor was to be treated with great compassion, he or she was usually in debt not because of self-indulgent motives but because of the inability to meet the basic needs of life.

Commercial debt is mentioned but with very little comment. Clearly it was not wrong for God’s people to be involved in commercial investments. They had to recognize, of course, that a loan carried with it not only responsibilities but also dangers, whether of loss or of exploitation. (This is evident in the many warnings about unwise involvement with lenders which could bring a borrower to the point of losing personal independence.)

So we see two kinds of debt in the Old Testament: interest-bearing loans to foreigners and interest-free loans to fellow Israelites. It was with respect to covenant brothers and sisters that more well-to-do Israelites were enjoined to be generous and forgiving. So important was this principle to God that it even appears in the Lord’s Prayer as the perfect example of godly forgiveness (Matthew 6:12: “Forgive us our debts, as we also have forgiven our debtors”). Neither of these types of debt is condemned. But the former tends to be discussed within the context of risk and the need to avoid being exploited. The latter is found within the context of generosity and forgiveness and the requirement not to exploit.

Are Debts Forgivable?

According to biblical teaching, borrowers were obliged under normal circumstances to repay their debts. This responsibility to meet one’s financial obligations is vividly illustrated by a provision recorded in Leviticus 25:39. Here a debtor in default could go so far as to sell himself into slavery. Obviously the responsibility to repay one’s debts was taken extremely seriously. However, the possibility of those debts being canceled (or debt-slaves released) was not ruled out. In accordance with sabbatical-year legislation, debtors were automatically relieved of their obligations every seventh year, whether or not they deserved compassionate treatment.

Compassion of this sort—the setting aside of the legitimate rights of lenders—was typical of all economic relations envisioned in the covenant community. God’s desire for his people was that they would enjoy economic stability and security as family units. Wealth was viewed as a divine blessing (Deut. 8:11-18, 28). This blessing was associated with God’s people living in obedience and was based totally on God’s compassion. Such financial mechanisms as the poor tithe (Deut. 14:28-29; Deut. 26:12), gleaning in the field (Deut. 24:19) and interest-free loans (Exodus 22:25-27; Leviticus 25:35-37; Deut. 23:19-20) were tangible ways by which God’s people could, in turn, show compassion for each other. Beyond income-maintenance programs, God provided for permanent mechanisms—such as the sabbatical year and Jubilee—to ensure that temporary misfortune barred no family from full participation in economic life (see Exodus 21:2; Exodus 23:11; Leviticus 25:1-7; Deut. 15:1-15).

It is important to keep two points in mind. The cancellation of debts in the Old Testament was done at legislated intervals, that is, every seventh year (sabbatical year) and every seven sabbaticals (Jubilee year), regardless of the performance of the debtor, good or bad. In addition, these borrowers were not involved in commercial life. They were usually poor farmers borrowing to preserve their ability to make a living and to feed their families. But the principle that can be legitimately extracted from the biblical model and applied to our modern free-market economies in North America today is that while debt is to be taken seriously, it could be canceled to achieve some higher purpose, such as the preservation of the family unit. No desirable goal is achieved when unscrupulous debtors are allowed to escape from their financial obligations. But the Old Testament did provide for the cancellation of debts as an act of mercy, with no stigma attached.

Conclusion

Debt, like so many other topics that Christians must evaluate in contemporary society, is a morally neutral concept. Never are God’s people told that debt is wrong—quite the opposite! In fact, one of the reasons that God entrusts his people with material means is because “there should be no poor among you” (Deut. 15:4). Loans were one way of restoring the poor to economic stability, especially if the lending was accompanied by a merciful and forgiving attitude. Well-off Israelites could also participate in commercial ventures provided that they made careful allowances for the risks involved. But access to loans brings with it all of the temptations associated with material life: self-indulgence, riskiness and exploitation. Debt is a two-edged sword, to be handled with care.

» See also: Consumerism

» See also: Credit

» See also: Credit Card

» See also: Money

» See also: Simpler Lifestyle

» See also: Stewardship

References and Resources

L. Burkett, God’s Principles for Operating a Business (Dahlonega, Ga.: Christian Financial Concepts, 1982), audiocassette; A. J. Johnson, A Christian’s Guide to Family Finances (Wheaton, Ill.: Victor Books, 1983).

—John R. Sutherland